A new concept is emerging: vibe marketing. Coined in tech, vibe marketing now describes a hands-on-yet-automated approach to managing customer engagement. In loyalty marketing, it means using intelligent tools to create highly personalized, data-driven programs—without getting lost in technical complexity. Rather than replace marketers, vibe marketing frees them to focus on strategy and creativity. For those looking to scale loyalty efforts with precision and agility, VEMT provides the structure and automation needed to bring the right “vibe” to every customer interaction.

Shopping Insights; a tool for Retailers

Only with US data at the moment, Google recently announced a potentially important tool for Retailers. It’s called ‘Shopping Insights’ (what else?) and it could well be an important step for retailers to become more data driven. Here’s what it means to you:

The Context of Shopping Insights

As a retailer, you are facing serious challenges. Not only should you solve how you are going to offer your products omni-channel (and now for real), or how you deal with the increasing fluidity of mobile shoppers, or if you should implement the latest fads around beacons and other in-store sensors, but the underlying necessity for all of this to work well is a well functioning customer data infrastructure. You just cannot handle any of the other challenges without recent and detailed customer data.

For classic retailers, the availability of customer data leads to insights. For active retailers, data can lead to (automated) actions, influencing the behavior of these customers. If you don’t have a loyalty program collecting real-time and continuous data about your customers, then you have a real issue that is growing by the day. Google alleviates that issue a bit by offering you insights in what shoppers are searching for. These insights can be seen as a new data source for active retailers.

The differences with Google Analytics

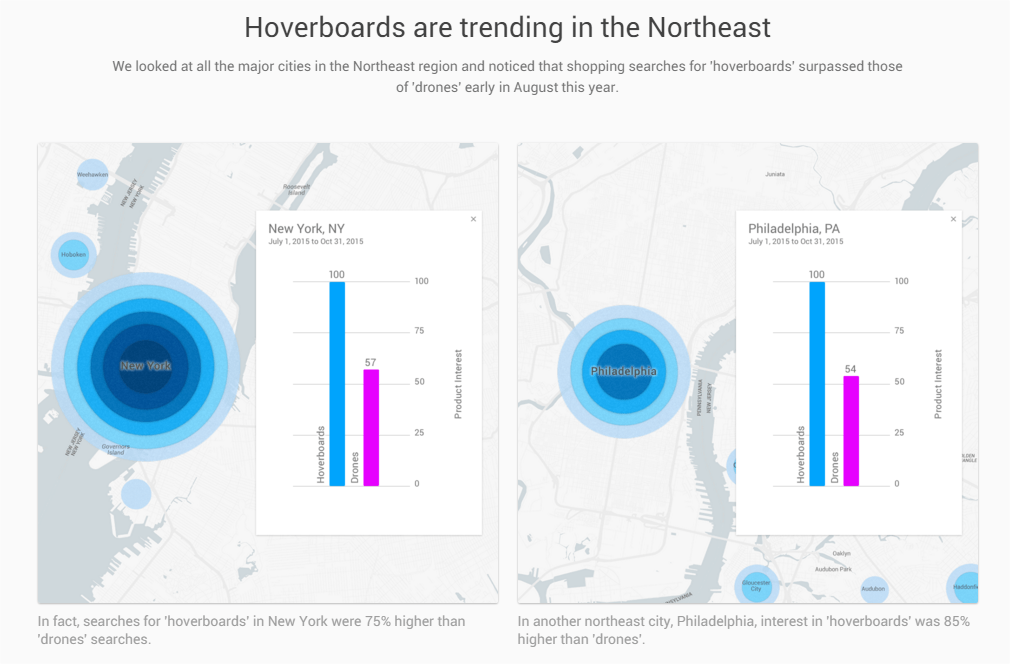

‘Nothing new’, you might respond, but that’s not entirely true. Whereas Google did provide insights in searches before through various tools, this new tool is specifically focused at shopper search behavior, rather than on all online searches, keywords and queries. It breaks down results from shopper searches by products, (US) cities, devices, and it illustrates the results in easy to read heat maps that can show changes throughout time. The time traveling through data provides interesting insights and can show you if interest in certain products might go over its maximum, or are still gaining strength.

What can you do with it in practice?

Your campaigns can be improved with the new tool. Shopping Insights shows the results based on locations targeted by AdWords. It also categorizes results by device, which can be helpful for fine-tuning campaigns, if you’re into that. And why wouldn’t you?

Google claims that although 87% of shoppers do research products online, 92% actually still makes purchases for these products in real brick-and-mortar stores. With this tool, you can refine those online campaigns that drive your offline traffic (especially by mobile searches) and improve stock levels and differentiate product stock planning per location. If your target group in (if the tools becomes available in Europe) let’s say London searches for different products than in Manchester, you could anticipate on that and avoid mismatches or overstocking.

Room for improvements

There are limitations, still. Interest from shoppers does not necessarily mean that they will actually buy. But it helps to know what they are actively searching for and if this grows or is in decline.

Shopping Insights currently works best when tracking major trends, rather than subtle differences. As far as I could find, tracking the difference in interest between blue shirts and light blue shirts will still be something for the future, as there are ‘only’ 5000 products included in the tool at this moment. I expect this to be a matter of time; Google is perfectly positioned to increase to millions of products within a few months. As soon as this happens, you can most likely spot local differences or national trends to which you would like to respond. With managing your stock levels and your advertising budgets, your communication and social media posts and interaction. For these, Shopping Insights could grow into a valuable tool, especially if you can combine the insights with other supporting data about your specific customers, and find a way to make this data actionable.

How will VEMT make this tool available to you?

For this ‘customer behavior data palette’ that you need, VEMT will actively provide you with information from all types of sources. We will include this new source when it will become available in Europe as well. Most importantly, we will add options to turn this information into actionable rules, allowing you to be an active merchant, creating autonomous access to your customers. Because there is where the value is.

Check it out at: Shopping Insights by Google